Global Focus Growth

The DSM Global Focus Growth strategy seeks long-term capital appreciation through investments in a concentrated portfolio of the stocks of quality US and international companies. We select portfolio holdings based on their presentation of predictable growth characteristics combined with share prices that represent attractive returns.

The strategy generally invests in 12 or fewer companies operating among North America, Europe, other developed, and emerging markets. Portfolio holdings typically have market capitalizations in excess of $10 billion. The strategy uses no leverage, futures, options or derivatives. Currency exposure is unhedged.

The Global Focus Growth strategy is available in:

- Managed Accounts

- CIF (can be made available)

- Chart

- Tables

- Notes

Periods ending March 31, 2024

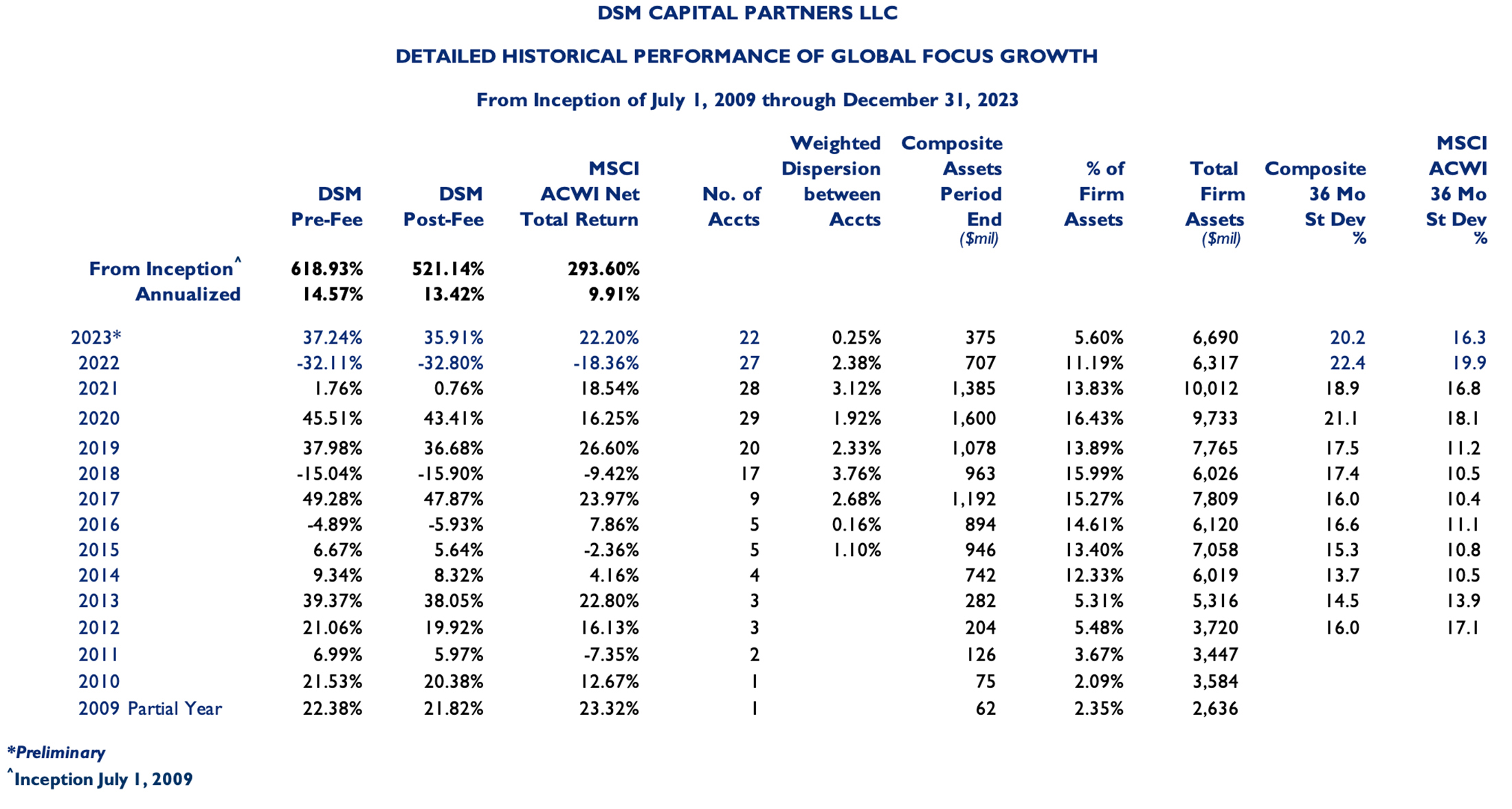

| March* | QTD* | Trail 12M* | 3 Years* | 5 Years* | 10 Years* | Cumulative*^ | Annualized*^ | |

|---|---|---|---|---|---|---|---|---|

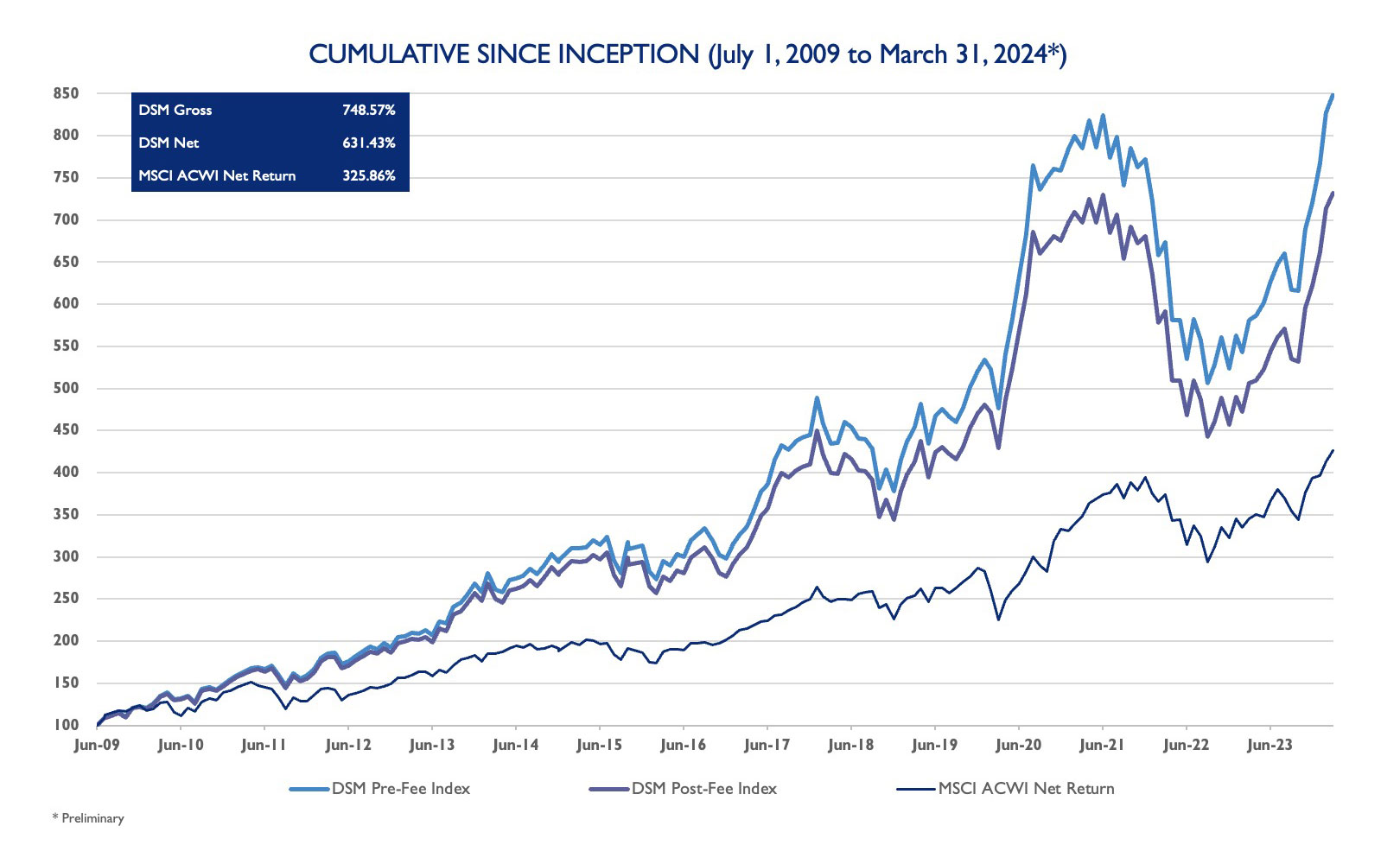

| Pre-Fee | 2.57% | 18.03% | 46.06% | 2.61% | 13.33% | 12.51% | 748.57% | 15.60% |

| Post-Fee | 2.57% | 17.76% | 44.64% | 1.60% | 12.11% | 11.35% | 631.43% | 14.44% |

| MSCI ACWI Net Total Return | 3.14% | 8.20% | 23.22% | 6.96% | 10.92% | 8.66% | 325.86% | 10.32% |

Annual Periods ending March 31, 2024

| DSM Pre-Fee | DSM Post-Fee | MSCI ACWI Net Total Return | |

|---|---|---|---|

| Quarterly | |||

| First Qtr-to-Date* | 18.03% | 17.76% | 8.20% |

| Yearly | |||

| 2024* | 18.03% | 17.76% | 8.20% |

| 2023 | 37.24% | 35.91% | 22.20% |

| 2022 | -32.11% | -32.80% | -18.36% |

| 2021 | 1.76% | 0.76% | 18.54% |

| 2020 | 45.51% | 43.41% | 16.25% |

| 2019 | 37.98% | 36.68% | 26.60% |

| 2018 | -15.04% | -15.90% | -9.42% |

| 2017 | 49.28% | 47.87% | 23.97% |

| 2016 | -4.89% | -5.93% | 7.86% |

| 2015 | 6.67% | 5.64% | -2.36% |

| 2014 | 9.34% | 8.32% | 4.16% |

| 2013 | 39.37% | 38.05% | 22.80% |

| 2012 | 21.06% | 19.92% | 16.13% |

| 2011 | 6.99% | 5.97% | -7.35% |

| 2010 | 21.53% | 20.38% | 12.67% |

| 2009 ^ | 22.38% | 21.82% | 23.32% |

GENERAL PERFORMANCE COMPOSITE FOOTNOTES

- Past performance is no guarantee of future results and individual accounts and results will vary. Materially different market or economic conditions could result in markedly different performance, including the possibility of loss. The content presented is for informational purposes only. It is not intended to reflect a current or past recommendation, investment, legal, tax or accounting advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. Except as otherwise specified, any companies, sectors, securities and/or markets discussed are solely for illustrative purposes regarding economic trends and conditions or investment process and may or may not be held by DSM Capital Partners LLC (“DSM”) or other investment vehicles or accounts managed by DSM. Investing entails risks, including possible loss of principal. There are also special risk considerations associated with international and global investing (especially emerging markets), small and mid-capitalization companies, or other growth and/or concentrated investment strategies.

- DSM, located in Palm Beach Gardens, Florida, is an investment adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended, managing separate accounts, pooled investment vehicles and wrap accounts for both institutional and high net worth investors.

- DSM primarily manages equities in a model portfolio method and therefore presents a single composite return for managed accounts of each strategy offered. In general, the Global Focus Growth strategy will invest in equity securities of large capitalization companies. Equity securities, as determined by DSM in its discretion include, but are not limited to, common stocks, preferred stocks, securities convertible into common stocks, rights and warrants. The Global Focus Growth strategy has no limit on the proportion of assets it can invest in the equity securities of domestic versus foreign companies. The Global Focus Growth strategy will generally contain 12 or fewer equity securities. DSM historically purchased non-US securities (otherwise known as local shares) for this model investment strategy. As of March 31, 2017, clients may specifically authorize DSM to purchase American Depository Receipts or similar securities instead of non-US securities (local shares) in order to facilitate smaller accounts. Clients understand and accept that the price of American Depository Receipts and similar securities may materially differ from the price of the non-US securities (local shares). Effective January 1, 2018, the Global Focus Growth strategy was redefined to include DSM’s Focus Growth strategy as the two strategies have closely mirrored each other over the recent past.

- DSM claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. DSM has been independently verified for the periods January 2002 -December 31, 2022. A firm that claims compliance with GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. The Global Focus Growth has had a performance examination for the periods July 2009 to December 31, 2022. The verification and performance examination reports are available upon request. Benchmark returns are not covered by the report of independent verifiers.

- DSM’s performance composite includes all discretionary Global Focus Growth managed accounts. The composite was created July 1, 2009. A complete list of composites descriptions, a list of pooled fund descriptions for limited distribution pooled funds, and a list of broad distribution pooled funds are available upon request, as well as policies for valuing portfolios investments, calculating performance, and preparing GIPS Reports, may be requested from Russell Katz, DSM Capital Partners LLC, 7111 Fairway Drive, Suite 350, Palm Beach Gardens, Florida 33418. Phone: 561-618-4000; email: [email protected].

- DSM first offered the Global Focus Growth strategy to clients during July of 2009. There was one client account in the composite for the full period from 2009-2011. There are non-fee-paying employees accounts as well as fee-paying client accounts in the composite presently.

- Performance is presented in US Dollars. Results are time-weighted and asset-weighted based on beginning-of-period asset values. Valuation is on a trade-date basis. Results include the reinvestment of dividends and other earnings. Dividends are realized on an accrual basis; cash equivalent dividends are realized on a cash basis. Composite returns are net of withholding taxes on foreign dividends. As of March 2017, reclaimed withholding taxes are recognized as income when received. Pre-fee results include the effect of commissions; post-fee results include the effect of commissions and management fees. Custody charges, where applicable, are not deducted from gross and net-of-fee performance. The 36-month annualized standard deviation measures the variability of the composite gross of fees and the benchmark returns over the preceding 36-month period. The 36-month standard deviation is not shown for periods comprising fewer than 36 monthly returns. Dispersion between accounts is the asset-weighted standard deviation of gross returns for active accounts with DSM for the entirety of a given year. Dispersion is only reported for years having five or more such accounts. Additional information regarding policies for calculating and reporting returns is available upon request.

- DSM’s management fee for the Global Focus Growth strategy is generally 1.0% per annum on the assets. DSM’s advisory fees are fully detailed in Part 2A of its Form ADV. This fee is charged quarterly in arrears. Certain accounts, if any, in the composite may have different fee structures (including performance fees) and certain accounts may involve non-fee expenses not included above. The performance figures presented do not reflect the deduction of investment advisory fees actually charged to the account in the composite. Rather, the performance results presented reflect the deduction of a model advisory fee. From inception of the composite on July 1, 2009, a model advisory fee of 1.0% per annum for Global Focus Growth has been used. The model advisory fee applied to 4Q2020 was adjusted to capture the effects of a performance fee charged to 3 accounts in the composite, the effect of these adjustments was an increase in the model advisory fee for 2020 from 1.0% to 2.1% for the full year. The model advisory fee will revert back to 1.0% in 1Q2021. From inception through December 31, 2016 DSM calculated monthly post-fee performance by applying one-third of the quarterly model fee to each month of a quarter. As of January 1, 2017, DSM calculates post-fee returns by deducting the entire quarterly model fee in the first month of the quarter, with no fee deduction in the second and third month of the quarter. Quarterly post-fee returns based on beginning-of-quarter market values may compound to more or less than monthly post-fee returns based on beginning-of-month market values. A complete list of composite descriptions, a list of pooled fund descriptions for limited distribution pooled funds, and a list of broad distribution pooled funds are available upon request, as well as policies for valuing portfolios investments, calculating performance, and preparing GIPS Reports.

- The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 47 country indices comprising 23 developed and 24 emerging market country indices. This index includes dividends reinvested net of withholding taxes. MSCI uses the withholding tax rate applicable to non-resident institutional investors that do not benefit from double taxation treaties. DSM uses the MSCI ACWI Index as a benchmark because it is a global industry standard. Characteristics of any benchmark may differ materially from accounts managed by DSM. The volatility of a benchmark may be materially different from the individual performance attained by a specific client investing within this strategy, and the holdings of the accounts contained within the composite may differ significantly from the securities that comprise the benchmark. Indices are not assessed a management fee and investors cannot directly invest in an index. In September of 2013, DSM retroactively changed the benchmark for the composite from the MSCI ACWI IMI Index to the MSCI ACWI Index. The MSCI ACWI Index is more representative of the strategy’s market capitalization range.

- Leveraged accounts, if any, in the composite involve non-discretionary leverage only. In such cases, per GIPS recommendations, the effect of leverage is removed by treating borrowing as a cash flow and adding back margin interest.

- There have been no material changes in the persons responsible for the investment management of the Global Focus Growth strategy since its inception.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the contained herein.

Revised: 02/26/2024